Workers’ Compensation Claims for Self-Insured Employers

Workers’ Compensation Claim for Self-Insured Employers

In Ohio, employers are required by law to provide workers’ compensation coverage for their employees in case of work related injuries. Employers have two options for doing so: state-funded or self-insured. Employers who are self insurers must meet certain requirements to be approved by the Ohio Bureau of Workers’ Compensation (BWC).

Employers who use self insurance must demonstrate sufficient financial strength and administrative ability to assure they promptly meet all obligations under Ohio Revised Code 4123.35. They also acknowledge ultimate responsibility for the administration of workers’ compensation.

Nearly one third of Ohio employers are self-insured so it is important to know the difference between state workers’ compensation insurance and self-insured employers.

Self-insured companies will pay bills associated with our work injury directly, rather than through the state.

Many large companies or corporations have the funds and resources to be self-insured, and this should not affect your coverage as an employee.

Every self insured employer is obligated to post a copy of Certificate of Employers Right to Pay Compensation Directly, and must be able to pay claims in a timely manner.

Self-insured employers’ insurance still provides for the following:

-Medical Expenses

Medical expenses for a work-related injury are generally covered by workers’ compensation programs. These expenses may include the cost of medical treatment, diagnostic tests, emergency room charges, hospitalization charges, doctor visits, and other miscellaneous costs associated with the injury. However, it is important to note that not all medical expenses will be covered under self insured workers’ compensation, and it is important to understand the difference between covered medical care and non-covered medical costs to be prepared financially in case of a claim.

When an employee makes a claim for workers’ comp, they will receive a claim number from the nominated insurer. The employee should provide this claim number directly to their treating doctors and medical providers. The medical provider should send their accounts directly to the insurer for payment. For an employer with self insurance, they will receive the bills directly.

-Wage Replacement Benefits

When a worker is injured on the job, they may be entitled to receive wage replacement benefits as part of their workers compensation claim. Wage replacement benefits are intended to compensate injured workers for their lost wages while they are unable to work due to their injury. In general, wage replacement benefits are usually equal to about two-thirds of the worker’s average weekly wage, but there is a fixed maximum amount that these benefits will not go over.

In Ohio, wage replacement benefits are calculated based on the worker’s average weekly wage at the time of the injury, subject to certain caps and minimums. Generally, employees filing workers compensation claims who are totally disabled due to their injury are entitled to receive wage replacement benefits equal to two-thirds of their average weekly wage, subject to a maximum and minimum amount set by state law. Workers who are only partially disabled may be entitled to receive partial wage replacement benefits.

It is important to note that workers comp insurance benefits are not taxed, so workers who receive wage replacement benefits will not have to pay income tax on those benefits.

If you have been injured at work and your employer is a self-insured company, it is critically important to have legal representation. My staff and I will walk you through the process and help you obtain maximum benefits allowed by law.

-Disability Compensation

Disability compensation benefits are a type of workers’ comp benefit that pays a portion of an employee’s income when they cannot work due to a work-related injury or illness. This type of benefit is designed to cover lost wages and help employees manage their expenses while they are unable to work. The duration of disability compensation benefits can vary depending on the severity of the injury or illness and the ability of the employee to return to work.

Frequently asked questions about self insured employers

I am often asked, “what if my employer doesn’t have workers’ compensation insurance coverage at all when I am injured on the job?

According to the Ohio Bureau of Workers’ Compensation, employers in Ohio are required by law to obtain workers’ compensation coverage for their employees, with few exceptions. If an employer does not have workers’ comp coverage and an employee files a claim, the employee may be eligible for benefits from the Ohio Bureau of Workers’ Compensation’s Uninsured Employer Fund. This Ohio State insurance fund provides limited benefits for eligible injured workers, such as medical expenses, temporary total disability compensation, and permanent total disability compensation. It is important to note that the process and eligibility for benefits may vary depending on the specific circumstances of the case, and it is advisable to seek the guidance of an experienced self insured workers’ compensation attorney.

How do self-insurance for workers’ compensation programs work?

To qualify for self-insurance, employers must meet certain financial strength and administrative ability requirements. Employers with self insured workers compensation program are responsible for administering their own workers’ comp claims in accordance with the laws and rules that govern self-insurance. The Ohio Administrative Code 4123-19-09 governs the complaint process pertaining to self-insuring employers. If an employer denies a medical bill, the employee can file a Motion (C-86) to request a hearing before the Industrial Commission (IC), which is a separate agency from BWC and hears all disputed issues in the claim.

How are workers compensation claims administered by self-insured employers to their employees in Cleveland, Ohio?

According to the Ohio Bureau of Workers’ Compensation, employers who self insure are responsible for the administration and processing of workers’ comp claims. This means that while the employer may retain an individual insurance carrier or third-party administrator to assist in managing claims and authorizing settlements, the ultimate responsibility lies with the employer for financial resources.

How do employees file a claim for a self-insured workers compensation employer?

According to the Ohio Bureau of Workers’ Compensation, employees of businesses with self insurance can file a workers’ comp claim by submitting a claim form to their employer within one year of the injury or illness. The employer may then investigate the claim and determine whether or not to accept it. If the claim is accepted, the employer is responsible for administering and processing the claim, although they may retain an individual or third-party administrator to assist in managing claims.

Are self-insured employers subject to the same workers’ compensation laws and regulations as state-funded employers?

Employers who self insure are ultimately responsible for the administration and processing of workers’ comp claims, but they must comply with all statutory and regulatory obligations. Therefore, employers who self insure are subject to the same workers’ compensation laws and regulations as state-funded employers in Ohio.

How does excess insurance work for self-insured employer?

According to the Ohio Bureau of Workers’ Compensation (BWC), excess insurance is an optional coverage that a self-insuring employer may obtain to cover all or part of a claims loss that exceeds a certain amount. If obtained, the current law requires the excess insurance policy to set a limit of at least $50,000 for any one disaster or event.

Hire a lawyer with experience in self insured workers compensation cases!

If your self-insured employer is not being fair, or mishandles your claim, call me immediately for a free consultation. We may also consider filing an SI-28 form, Filing of Allegation Against a Self-Insured Employer.

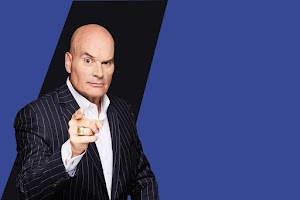

If you were injured at work, call me at 1 (800) 556-4769. As your Ohio workers’ compensation lawyer, I’ll be there for you, and I’ll Make Them Pay!®

ASK TIM A QUESTION

NO COST TO YOU!

There's the Tim Misny you see on the billboards and on TV, but there's another Tim Misny that I know up close and personal.

The Tim Misny I know is genuinely passionate about helping the hard working little folks who get pushed around the big folks. He actually, really honestly cares about people who run into bad luck at no fault of their own. Tim has quietly, out of the sight of cameras and with no fanfare shared generously with the marginalized in our society; single moms, Veterans and others without expecting anything in return.

He calls them like he sees them and you wouldn't want to take your troubles to anyone else.

Thank you Tim for being a light in this community!

City, State and Above State Level Situation .

Pro Se !

Thank you Tim

father figure one day. Tim loves nature & shares the true beauty of nature with how he raises his kids. From biking through trails & having his kids learn how to nurture the family garden - he teaches valuable lessons on how to appreciate the world we live in. I know that Tim is just a phone call away & always urgent to responding no matter the situation. He has given me some of the greatest advice & continously throwing positive energy my way! I'm honored to know him & be a friend of his. He is the true practioneer of changing lives & paying it forward. He has taught me so much in just a short amount of time. Tim Misny, a man that wakes up every single day to make a difference!

After I helped him through the checkout and he left, many different employees at the garden center asked me if I knew who that man was. I did not. They told me, “That’s Tim Misny!” Once I figured out “who” Tim Misny was, my confidence grew. It was a pivotal moment. One in which steered the rest of my life. His words stuck with me. I worked hard and obtained my Associate’s Degree in Criminal Justice. I was hired by a local Law Enforcement Agency at the age of 21. I was sent to the Ohio State Highway Patrol Academy, which was an extremely tough place to be, to say the least. At the Academy, they try to break those who don’t have a determined spirit. On days I wanted to quit, I remembered Tim’s words. Maybe it was fate, maybe it was random chance.... I’ll never know But, Tim Misny helped me have the confidence and determination that was necessary to be where I’m at today. I’ve been a law enforcement officer for over 16 years. I’ve told this story to many of my coworkers.

Tim, you’ll never understand how your words that spring day helped shape my future. Your words enabled me to provide a great life for myself and my family. I’m forever grateful.

Mike

The personal attention and clarity of the matter and specifics, gave me a state of comfort and satisfaction that I could have found nowhere else! I will be forever grateful to have Tim Misny as my attorney and my friend!

I am a businessman in the Greater Cleveland area and have directed various members of my staffs as well as personal friends to Tim for solutions to their personal injury case needs. All my referrals have been more than pleased with the service and personal treatment they have received from Tim and his staff.

I strongly recommend Tim Misny and his associates should you ever need the finest legal services available in Ohio! Trust is his number one priority, trust in knowing that you will be his client second, his friend first!