An employer finds utilizing an independent contractor an attractive prospect. They do not pay employment or withholding taxes, benefits, or workers compensation coverage. An independent contractor is not eligible for unemployment benefits and exempt from wage, hour and employment discrimination laws.

With that being said, more often than not, even if your contract states that you are an independent contractor, you are not. In the state of Ohio, an employer-employee relationship exists when an employer hires an individual to perform services, yet maintains control over the manner and means by which the individual performs the service.

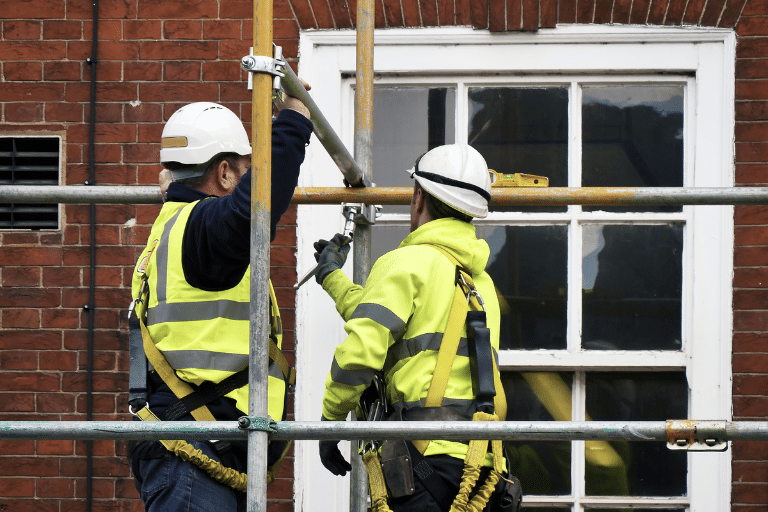

Why is that important? Benefits aside, if you are injured at work, it is imperative for both your sake, and that of your loved ones, to know what your rights are. According to the Ohio Bureau of Workers Compensation there were over 704,000 open injury claims for 2017. With statistics like that, it is far too important not to be informed.

If you or a loved one were injured on the job as an independent contractor, call me, let me determine if you are an employee under Ohio law and eligible for Workers Compensation benefits. Do not allow your rights to be violated.

I will be there for you, and I’ll Make Them Pay!®

Author: Tim Misny | For more than 40 Years, personal injury lawyer Tim Misny has represented the injured victim in birth injury, medical malpractice, workers compensation, and catastrophic injury/wrongful death cases, serving “Cleveland, Akron/Canton, Columbus, Dayton and neighboring communities.” You can reach Tim by email at misnylaw.com/ask-tim-a-question/ or call at 800-556-4769.