Why You Need Umbrella Insurance Coverage

Why You Need Umbrella Insurance Coverage in Ohio

You Get What You Pay For

The best free, friendly advice I could possibly give you is to purchase “umbrella” coverage as part and parcel of your automobile insurance policy.

If I had a quarter for every time there was inadequate insurance coverage to compensate my clients in a bad automobile accident, we could all go on vacation for a month.

In terms of automobile insurance coverage an “umbrella” policy is just that. It is insurance above and beyond your existing auto policy. For instance, if you have a $100k/$300k auto insurance policy (meaning $100k is available per person and $300k is available in the aggregate), it may not be sufficient to cover all of the damages of a bad accident. For very little money, you could have added a $1,000,000 umbrella rider/policy that would sufficiently cover the damages.

This additional coverage will cover you, your family, and/or anyone using your vehicle with your permission, whether they are at fault in an accident or a negligence-free victim. Typically, the annual premium for an umbrella policy is several hundred dollars per year. It’s really a great deal!

The need to obtain such coverage is overwhelming. Most drivers, and I’m saying at least 50% if not more, do not have auto insurance or just have the state minimum.

Therefore, one would have to assume, for insurance purposes, that if they or a loved one are made a victim in a car accident, the offending party WILL NOT have sufficient coverage to pay for the damages.

The damages in car accidents can include medical bills and lost wages, future medical treatment, therapy, surgeries, and rehab, as well as potentially a lifetime of diminished earning capacity.

The aggregate of these damages can exceed seven figures in a heartbeat.

It is my experience that insurance agents as a matter of common practice, do not inform their clients as to the existence of “umbrella” coverage.

Recently, I represented a family whose daughter was severely injured in a car accident. The offending party had minimal insurance coverage. My client was living with her parents and driving her father’s car at the time of the accident. Her father carried a $100k/$300k policy. Though I valued her case at approximately $2.5 million, tragically, we were limited to her dad’s $100,000 policy.

When I asked her father, a well-educated health care professional, if he had an “umbrella,” he said, “What do you mean…for rain?” In his 25-year-relationship with his insurance agent, the agent NEVER explained to this gentleman, the existence and compelling need for an “umbrella” policy.

I find that to be reprehensible.

Shockingly, Ohio courts have found an insurance agent owes no fiduciary duty to his or her clients. That is utter nonsense. The reason why insurance companies do not explain and recommend “umbrella” policies is because that’s when they have to pay out the big bucks.

Time and time again, I encounter the situation wherein an insurance agent fails to recommend an “umbrella” and consequently, the client is involved in a bad accident and there is not enough coverage to make them whole.

While insurance agents typically do not recommend “umbrella” coverage, they do suggest medical payment provisions. A medical payment provision is an amount of money available, typically $5,000, for payment of medical expenses incurred in an accident.

The caveat, however, is that medical payment provisions can only be accessed if there is no other available medical payment coverage, such as workers’ compensation and/or a person’s own health insurance. In the rare instance that a medical payment provision is accessed, virtually every insurance policy has a subrogation clause that demands that the auto policy be reimbursed dollar for dollar once the claim is resolved.

In essence, people pay a significant amount for medical payment provisions that they are rarely able to use. Instead of paying a premium for medical payment provisions, people would be much better off using those same funds to purchase “umbrella” coverage.

Do yourself a favor, pick up the phone today, and call your insurance agent. Ask about the affordability of “umbrella” coverage for you and your family. When he or she is done giving you a quote, ask them why they never told you about it in the first place.

What is Umbrella Insurance?

Liability Coverage

This insurance is designed to provide an additional layer of liability coverage beyond the limits of your standard home and auto insurance policies. While these policies offer valuable protection, they may have limitations on the amount they can pay out in the event of a claim. An umbrella policy acts as a financial safety net, ensuring if you face a substantial liability claim, you won’t be personally responsible for covering the excess costs. This can be particularly important in cases where lawsuits result in significant financial judgments.

Protection Against Wrongdoing

Nobody plans to be involved in an accident or to cause harm to others, but accidents do happen. If you find yourself in a situation where you are held legally responsible for injuring someone, or damaging their property, an umbrella insurance policy can step in to help cover the associated costs. This includes not only the medical expenses of the injured party, but also legal fees, settlements, and even lost wages if the injured person is unable to work.

Property Damage

Auto accidents or mishaps on your property can lead to significant property damage. If the damage exceeds the liability limits of your auto or homeowners’ insurance policies, an umbrella policy can bridge the gap. For instance, if you cause a multi-vehicle accident with extensive property damage, your auto insurance may fall short in covering the full costs. An umbrella policy can be a financial lifesaver in such scenarios, preventing you from having to dip into your savings or liquidating other assets to cover the excess costs.

Wrongful Death Settlement

Tragically, accidents can sometimes result in loss of life, leading to wrongful death claims. These claims can result in substantial settlements or judgments against you, including compensation for the deceased person’s family. An umbrella insurance policy can provide critical support in helping to cover the legal fees and settlements associated with a wrongful death claim, and to ensure your personal assets are not at risk.

Surgery

In the unfortunate event that you or a family member is injured due to an accident or negligence for which you are held liable, medical bills can quickly add up. This may include expenses for surgery and surgical intensive care units. An umbrella policy can offer peace of mind by helping to cover these unexpected and potentially high medical costs. This will ensure you or your loved one receives the necessary care without causing financial strain.

Medical Bills

Liability claims can extend to cover medical expenses incurred by others who are injured on your property. For example, if a guest slips and falls while visiting your home, they may require medical treatment, including surgical procedures. An umbrella insurance policy can step in to cover these medical bills, sparing you from having to pay out of pocket.

Peace of Mind

Beyond the financial aspects, umbrella insurance provides invaluable peace of mind. It acts as a safety net, allowing you to enjoy life without the constant worry of unforeseen accidents or lawsuits draining your finances. Knowing that you have this extra layer of protection can enhance your overall sense of security and financial well-being.

This type of insurance policy is a vital tool for protecting your financial stability and assets in the face of unexpected accidents. It will help cover liability claims, property damage, and even more serious situations like wrongful death settlements and surgical procedures. This offers comprehensive coverage and peace of mind in an unpredictable world.

When You Need Umbrella Insurance

Medical Malpractice – Mishandled Surgical Procedure

In the unfortunate event that you or a family member experience a mishandled surgical procedure resulting in serious injury or complications, this insurance policy can offer substantial financial support. It not only covers the medical bills, including potential stays in the surgical intensive care unit, but also helps you pursue a legal claim against the healthcare provider for the wrongdoing. This additional financial backing is crucial for obtaining the best possible medical care and to seek justice.

Homeowner’s Liability

Mishaps on your property can lead to liability claims. For example, if a guest at your home sustains an injury due to a slip and fall, your home insurance policy may cover a portion of their medical expenses. However, if their injuries are severe and result in prolonged medical treatment and surgery, the costs can quickly surpass the limits of your home insurance. Umbrella insurance fills this gap. You can cover not only the medical bills, but also potential legal expenses if the injured party files a lawsuit.

Boating or Recreational Accidents

If you own a boat, engage in recreational activities, or even host gatherings on your boat, accidents can happen. In the event of injuries or property damage related to boating or recreational activities, this type of insurance can provide the extra financial protection needed. It will cover medical expenses, property damage, and potential legal liabilities.

Umbrella insurance extends its protective coverage over various situations, including medical malpractice, auto accidents and home liability incidents. It is important to also be covered for accidents related to boating or recreational activities. The unlimited financial support to cover unforeseen expenses and liabilities, provides a sense of financial security in a wide range of circumstances.

Who Does Umbrella Insurance Benefit

Homeowners

Homeowners can benefit from umbrella insurance because it extends liability coverage beyond the limits of their standard home insurance policy. In the event of an accident on their property, this insurance can cover medical expenses and legal fees that may exceed their home insurance limits. It will safeguard your assets and savings.

Parents

Parents often have higher liability exposure due to family activities, hosting events, and having teenage drivers. Umbrella insurance can help protect parents from costly liability claims stemming from accidents or injuries involving their children – whether at home, on the road, or during recreational activities.

Business Owners

Business owners can face legal challenges and liability claims related to their operations. Umbrella insurance can offer additional financial protection by covering legal costs and settlements in a lawsuit. This helps business owners safeguard their personal assets from potential business-related liabilities.

Landlords

People who own rental properties may encounter liability issues involving tenants or property maintenance. Umbrella insurance can provide extra coverage for liability claims, including those related to tenant injuries, property damage, or other landlord responsibilities.

Drivers

Drivers, especially those with high net worth, can benefit from umbrella insurance as it provides added liability coverage beyond the limits of their auto insurance. In the event of a serious accident where they are at fault, umbrella insurance helps to cover medical expenses, property damage, and potential legal costs that may exceed their auto insurance limits.

High-Net-Worth Individuals

Individuals with substantial wealth are often targets for larger liability claims. Umbrella insurance is especially crucial for high-net-worth individuals, as it shields their wealth and investments from being seized in the event of a substantial judgment or settlement.

Frequent Travelers

Travelers may encounter various risks while abroad, including accidents, injuries, or incidents involving rented properties. Umbrella insurance can provide worldwide coverage, offering financial protection in case they face liability claims, lawsuits, or medical expenses while traveling.

Pet Owner

Pet owners may face liability claims if their pets injure someone or cause property damage. Umbrella insurance can help cover medical bills and legal fees resulting from such incidents, ensuring that pet owners are financially protected from unexpected pet-related liabilities.

Event Hosts

People who frequently host gatherings, parties, or events at their homes can benefit from umbrella insurance. It provides protection against liability claims arising from accidents or injuries that occur during these events, ensuring that hosts are not financially burdened by unexpected legal expenses.

Umbrella insurance offers an extra layer of financial protection for a wide range of individuals. This includes homeowners, parents, business owners, landlords, boat owners, drivers, high-net-worth individuals, frequent travelers, pet owners, and event hosts. It helps safeguard your assets and financial well-being by covering liability claims, legal fees, and medical expenses that may exceed the limits of your primary insurance policies.

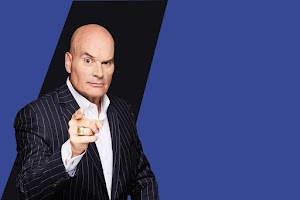

Insurance companies are some of the biggest corporate entities, and they have very deep pockets. They are also notorious for not paying out damages. If you need help, call the Law Offices of Tim Misny today for a free consultation. I’ve successfully pursued thousands of cases, and I can help you too.

ASK TIM A QUESTION

NO COST TO YOU!

There's the Tim Misny you see on the billboards and on TV, but there's another Tim Misny that I know up close and personal.

The Tim Misny I know is genuinely passionate about helping the hard working little folks who get pushed around the big folks. He actually, really honestly cares about people who run into bad luck at no fault of their own. Tim has quietly, out of the sight of cameras and with no fanfare shared generously with the marginalized in our society; single moms, Veterans and others without expecting anything in return.

He calls them like he sees them and you wouldn't want to take your troubles to anyone else.

Thank you Tim for being a light in this community!

City, State and Above State Level Situation .

Pro Se !

Thank you Tim

father figure one day. Tim loves nature & shares the true beauty of nature with how he raises his kids. From biking through trails & having his kids learn how to nurture the family garden - he teaches valuable lessons on how to appreciate the world we live in. I know that Tim is just a phone call away & always urgent to responding no matter the situation. He has given me some of the greatest advice & continously throwing positive energy my way! I'm honored to know him & be a friend of his. He is the true practioneer of changing lives & paying it forward. He has taught me so much in just a short amount of time. Tim Misny, a man that wakes up every single day to make a difference!

After I helped him through the checkout and he left, many different employees at the garden center asked me if I knew who that man was. I did not. They told me, “That’s Tim Misny!” Once I figured out “who” Tim Misny was, my confidence grew. It was a pivotal moment. One in which steered the rest of my life. His words stuck with me. I worked hard and obtained my Associate’s Degree in Criminal Justice. I was hired by a local Law Enforcement Agency at the age of 21. I was sent to the Ohio State Highway Patrol Academy, which was an extremely tough place to be, to say the least. At the Academy, they try to break those who don’t have a determined spirit. On days I wanted to quit, I remembered Tim’s words. Maybe it was fate, maybe it was random chance.... I’ll never know But, Tim Misny helped me have the confidence and determination that was necessary to be where I’m at today. I’ve been a law enforcement officer for over 16 years. I’ve told this story to many of my coworkers.

Tim, you’ll never understand how your words that spring day helped shape my future. Your words enabled me to provide a great life for myself and my family. I’m forever grateful.

Mike

The personal attention and clarity of the matter and specifics, gave me a state of comfort and satisfaction that I could have found nowhere else! I will be forever grateful to have Tim Misny as my attorney and my friend!

I am a businessman in the Greater Cleveland area and have directed various members of my staffs as well as personal friends to Tim for solutions to their personal injury case needs. All my referrals have been more than pleased with the service and personal treatment they have received from Tim and his staff.

I strongly recommend Tim Misny and his associates should you ever need the finest legal services available in Ohio! Trust is his number one priority, trust in knowing that you will be his client second, his friend first!