Insurance Companies and Personal Injury Cases

How Do Insurance Companies Handle Personal injury Cases

How are Personal Injury Cases Handled by Insurance Companies?

Have you ever wondered how insurance companies handle personal injury cases? You may know someone who’s had an injury claim, or heard about a specific injury case on the news, yet you’re probably uncertain how the personal injury claims process works. Don’t worry, you’re not alone, many others wonder the same thing. It’s important to understand what occurs should you be in the unfortunate position of needing to file an injury claim. We’ll review how insurance companies handle these cases, and explain just how important it is to have an experienced personal injury attorney by your side.

Injured in a Car Crash

Many personal injury cases begin with an auto accident. Two cars collide on a roadway because one driver wasn’t paying attention and failed to see the vehicle in front of them apply their brakes. The victim who was rear-ended, has a damaged car and could suffer injuries such as whiplash, broken bones, or worse. What happens next is up to the insurance company.

The at-fault driver contacts their insurance company. The company obtains the police records, which includes information from witnesses. They also speak to both the driver who is insured under them, as well as the driver of the other vehicle. They then review all of the details, examine the damage to both vehicles, and determine whether the victim will be compensated and how much they will offer to pay. As long as the insured has sufficient liability insurance, many of the victim’s medical bills and auto damage, among other things should be covered. The problem is that this “coverage” comes about in the form of a settlement.

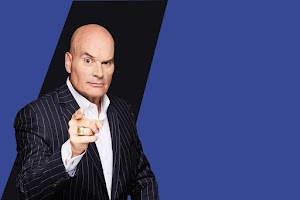

Does it sound like your compensation is completely out of your control? Don’t let it be. Insurance companies are a business, and their goal is to make money, not to make sure you get all the help you need to recover. I have more than 40 years of experience dealing with insurance companies, and I’ll Make Them Pay!®

Process of Filing an Injury Claim

Assess Your Personal Injuries

The initial step in pursuing a personal injury claim is to carefully assess the nature and extent of your personal injuries resulting from an accident or incident. Seek immediate medical attention to diagnose and document your personal injuries comprehensively. It’s crucial to maintain detailed medical records that not only outline your medical expenses, but also describe the extent of your personal injuries and the treatment received. These medical records will serve as critical evidence to support your personal injury claims.

Notify the Insurance Company

After the incident, promptly inform the insurance company about your intention to file a personal injury claim. Provide them with essential details about the accident and your resulting personal injuries. This notification is the first step in initiating the personal injury claims process, as it puts the insurance company on notice of your intent to seek compensation for your medical expenses and other damages.

Gather Evidence

To bolster your personal injury claims, gather all relevant evidence pertaining to the incident. This evidence can include photographs of the accident scene, statements from witnesses, and any documentation related to your personal injuries and associated medical expenses. This collection of evidence will help substantiate your case and demonstrate the extent of your injuries and the financial impact of your medical expenses. Evidence will support your claim to obtain maximum compensation.

Medical Records and Bills

As an integral part of your personal injury claims, share your meticulously documented medical records and bills with the insurance company. These records serve as crucial pieces of evidence, as they provide a detailed account of your personal injuries, the treatment you’ve received, and the corresponding medical expenses incurred. Accurate and thorough medical records will play a pivotal role in establishing the link between your personal injuries and the resulting medical expenses.

Negotiate with the Insurance Company

Following the submission of your personal injury claims, the insurance company may extend a settlement offer as part of their assessment of your case. I will review this settlement offer carefully and negotiate on your behalf to ensure that it sufficiently covers your medical expenses and addresses the full spectrum of your damages. These include pain and suffering, lost wages, and other relevant costs. As you know, I’ll Make Them Pay!®

Types of Claims

Accident Insurance Claim:

A car accident insurance claim is filed when an individual is injured in a motor vehicle collision. It involves seeking compensation for personal injuries and damages sustained as a result of the accident. This process typically includes providing police reports, medical treatment records, and other relevant evidence to the claims adjuster of the at-fault party’s insurance company.

Slip and Fall Insurance Claim:

A claim for a slip and fall is made when someone is injured due to a hazardous condition on another party’s property. This can include injuries in stores, homes, or public places. The injured party seeks compensation for medical treatment and other damages, by submitting an insurance claim to the property owner’s insurance company. This claim is assessed by an insurance adjuster.

Medical Malpractice Insurance Claim:

In a medical malpractice insurance claim, individuals who have suffered harm due to medical negligence by healthcare professionals pursue compensation for their injuries. They provide evidence of medical treatment and expert opinions to support their personal injury case. This information is reviewed by the defendant’s insurance adjusters.

Dog Bite Insurance Claim:

When a person is bitten or attacked by someone else’s dog, they can file a dog bite insurance claim. This type of personal injury claim seeks reimbursement for medical treatment, pain and suffering, and other damages. The injured party typically submits their claim to the dog owner’s homeowner’s insurance company.

Product Liability Insurance Claim:

A product liability insurance claim is filed when a defective product causes personal injuries. Those injured by the product seek compensation for their medical treatment, lost wages, and other damages, by filing a claim against the manufacturer’s or distributor’s insurance company.

Workplace Injury Insurance Claim:

In cases of workplace injuries, employees can file a work injury insurance claim through their employer’s workers’ compensation insurance. This type of insurance claim covers medical treatment and lost wages resulting from injuries sustained on the job.

Wrongful Death Insurance Claim:

When a person dies because of someone else’s negligence or wrongful actions, their family members may file a wrongful death insurance claim. This claim seeks compensation for medical and funeral expenses, as well as the emotional and financial losses suffered by surviving family members.

These types of personal injury insurance claims involve submitting evidence, such as police reports and medical treatment records to the respective insurance adjusters or claims adjusters. The evidence is for evaluation and potential compensation.

Damages

Medical Expenses: This includes the costs of medical treatment, surgeries, hospitalization, doctor visits, prescription medications, rehabilitation, and any other healthcare-related expenses incurred due to the injury.

Lost Wages: Compensation for income and wages lost as a result of the injury, including any missed workdays, reduced earning capacity, or inability to return to your previous job.

Pain and Suffering: Damages for physical and emotional distress caused by the injury, encompassing pain, discomfort, anxiety, and emotional trauma experienced during and after the incident.

Property Damage: Reimbursement for damage to your personal property, such as a vehicle in a car accident, or personal belongings affected by the incident.

Loss of Consortium: In some cases, spouses or family members may be eligible for compensation due to the loss of companionship, support, and intimacy resulting from the injured person’s condition.

Disfigurement and Scarring: Compensation for any visible scars, disfigurement, or physical deformities resulting from the injury or medical treatments.

Future Medical Expenses: Provisions for anticipated medical treatments and ongoing care needed as a direct result of the injury, including long-term rehabilitation, therapies, and medical equipment.

Emotional Distress: Damages awarded for the psychological and emotional trauma experienced due to the incident, which may include anxiety, depression, and post-traumatic stress disorder.

Loss of Enjoyment of Life: This is compensation for the diminished ability to participate in activities and enjoy life as you had before the injury.

Wrongful Death Damages: In wrongful death cases, compensation for funeral and burial expenses, as well as loss of financial support and companionship for surviving family members.

Punitive Damages: In rare cases, punitive damages may be awarded as a form of punishment for the at-fault party’s egregious conduct, or to deter similar behavior in the future.

Out-of-Pocket Expenses: Reimbursement for any expenses incurred directly as a result of the injury, such as transportation costs for medical appointments, home modifications, or necessary assistive devices.

Loss of Future Earnings: Compensation for the projected income and career opportunities lost due to the injury, especially if it leads to a long-term or permanent disability.

Why Does the Insurance Company Want You to Settle?

The injured victim should always be evaluated at the nearest medical facility to assess the degree of injury. At this juncture, it is also critical for the victim to seek medical attention as soon as possible. Additionally, the at-fault driver’s policy may have coverage caps that limit the settlement amount. As such, the offered settlement may not be enough to cover lost wages, repairs, medical bills, and everything else that must be paid due to the other driver’s negligence.

You have every right to refuse that settlement and then sue the other driver in court. (You cannot outright sue the insurance company.) The insurance company will hire a lawyer to represent their interests in the case, which involves representing the at-fault driver. During the court proceedings, the burden is on you to prove the other driver was negligent. Neither you nor your lawyer is allowed to mention that the insurance company is involved, even though they clearly are.

Obviously, the other driver’s insurance company will not be looking out for your needs, which is why you need to call me. It’s fair to say insurance companies don’t like me because I’ll Make Them Pay!®

Frequently Asked Questions

What Should I Do Immediately After an Accident to Protect My Personal Injury Claim?

After an accident, prioritize safety and seek medical attention if necessary. Notify the police and obtain a copy of the accident report. Gather contact information from witnesses, take photos of the scene and injuries, and document all relevant details. Avoid discussing fault or accepting blame. Contact your insurance company to report the incident..

How Do I Communicate with the Other Party’s Insurance Company?

When communicating with the other party’s insurance company, be cautious. You are not obligated to provide a recorded statement, and it’s advisable to consult with me, your personal injury attorney before doing so. Stick to providing essential facts about the accident and your injuries without admitting any fault. Avoid discussing your medical history or offering more information than necessary. Let me handle the interactions with the insurance company to protect your rights.

Should I Accept the First Settlement Offer from the Insurance Company?

Generally, it is not advisable to accept the first settlement offer from the insurance company. Initial offers are often lower than what you may be entitled to. It’s crucial to contact me, so I can assess the offer’s fairness and negotiate on your behalf. I will consider your medical expenses, lost wages, pain and suffering, and other damages to ensure you receive proper compensation.

What If the Insurance Company Denies My Personal Injury Claim?

If your personal injury claim is denied by the insurance company, don’t panic. It’s not uncommon for insurers to initially deny claims. You have the option to appeal the decision or pursue legal action by filing a lawsuit against the at-fault party. I will explore your next steps, and help you build a stronger case to prove liability and damages.

How Long Will the Personal Injury Claim Process Take?

The duration of the personal injury claim process varies widely depending on factors such as the complexity of the case, the severity of injuries, and the willingness of the insurance company to negotiate. Some claims can be resolved in a few months, while others may take several years if they go to trial.

If you’ve been injured by a negligent driver, call me and I’ll Make Them Pay!®

ASK TIM A QUESTION

NO COST TO YOU!

There's the Tim Misny you see on the billboards and on TV, but there's another Tim Misny that I know up close and personal.

The Tim Misny I know is genuinely passionate about helping the hard working little folks who get pushed around the big folks. He actually, really honestly cares about people who run into bad luck at no fault of their own. Tim has quietly, out of the sight of cameras and with no fanfare shared generously with the marginalized in our society; single moms, Veterans and others without expecting anything in return.

He calls them like he sees them and you wouldn't want to take your troubles to anyone else.

Thank you Tim for being a light in this community!

City, State and Above State Level Situation .

Pro Se !

Thank you Tim

father figure one day. Tim loves nature & shares the true beauty of nature with how he raises his kids. From biking through trails & having his kids learn how to nurture the family garden - he teaches valuable lessons on how to appreciate the world we live in. I know that Tim is just a phone call away & always urgent to responding no matter the situation. He has given me some of the greatest advice & continously throwing positive energy my way! I'm honored to know him & be a friend of his. He is the true practioneer of changing lives & paying it forward. He has taught me so much in just a short amount of time. Tim Misny, a man that wakes up every single day to make a difference!

After I helped him through the checkout and he left, many different employees at the garden center asked me if I knew who that man was. I did not. They told me, “That’s Tim Misny!” Once I figured out “who” Tim Misny was, my confidence grew. It was a pivotal moment. One in which steered the rest of my life. His words stuck with me. I worked hard and obtained my Associate’s Degree in Criminal Justice. I was hired by a local Law Enforcement Agency at the age of 21. I was sent to the Ohio State Highway Patrol Academy, which was an extremely tough place to be, to say the least. At the Academy, they try to break those who don’t have a determined spirit. On days I wanted to quit, I remembered Tim’s words. Maybe it was fate, maybe it was random chance.... I’ll never know But, Tim Misny helped me have the confidence and determination that was necessary to be where I’m at today. I’ve been a law enforcement officer for over 16 years. I’ve told this story to many of my coworkers.

Tim, you’ll never understand how your words that spring day helped shape my future. Your words enabled me to provide a great life for myself and my family. I’m forever grateful.

Mike

The personal attention and clarity of the matter and specifics, gave me a state of comfort and satisfaction that I could have found nowhere else! I will be forever grateful to have Tim Misny as my attorney and my friend!

I am a businessman in the Greater Cleveland area and have directed various members of my staffs as well as personal friends to Tim for solutions to their personal injury case needs. All my referrals have been more than pleased with the service and personal treatment they have received from Tim and his staff.

I strongly recommend Tim Misny and his associates should you ever need the finest legal services available in Ohio! Trust is his number one priority, trust in knowing that you will be his client second, his friend first!