Borrowed Vehicle Accidents

Borrowed Car Accident Attorney

Nobody expects to be involved in a serious car accident, yet collisions can happen unexpectedly and without warning. Traffic accidents can be scary under any circumstances, and it can be particularly frustrating to know the other driver responsible for your accident was driving a borrowed car.

You’re likely concerned as to who will be liable for your injuries, and pay for your losses. As an experienced Cleveland car accident attorney, I want to assure you that you can seek compensation with against a driver in a borrowed vehicle even if the driver does not have his or her own insurance.

What is a Borrowed Vehicle Accident?

A borrowed vehicle accident is a collision in which one of the drivers involved in the crash was driving a borrowed vehicle. The vehicle could have been borrowed from a friend, relative, work associate, etc. A borrowed vehicle also means the driver does not own the car involved in the accident.

For example, if a teenager borrows a friend’s car and causes an accident, we would describe the collision as a borrowed vehicle accident. Similarly, if a family member borrows a car and is involved in a crash, this too is described as a borrowed car accident.

Who Pays for a Borrowed Vehicle Accident?

Why are borrowed vehicle accidents so confusing? A person may be injured in an accident, and the at-fault driver who borrowed the car may not have their own insurance. The injured party may be worried as to who will be responsible for paying the fees associated with car repairs, medical bills, lost wages and more!

The AAA Foundation for Traffic Safety explains, car insurance usually follows the vehicle. Accordingly, you should be able to file a third-party claim against the owner of the borrowed vehicle.

If an insurance payout is insufficient to cover your bills, your may seek additional compensation via a lawsuit. Car accident lawyers like myself, have vast experience filing personal injury claims against negligent drivers. Call me today to discuss your car accident claim!

Circumstances:

The owner of the borrowed vehicle has insurance:

If the owner of the borrowed vehicle has insurance, their insurance company’s policy serves as the primary source of coverage for the car accident. In Ohio, auto insurance coverage typically follows the vehicle, meaning that the owner’s insurance policy extends to anyone who operates the vehicle with their permission.

For example, if Sarah borrows her friend John’s car and causes an accident, John’s insurance policy would be the first to cover the damages. If John has liability coverage, it should pay for the injured car accident victims’ medical bills, vehicle repairs, and other related expenses, up to the policy limits. In cases where the damages exceed the insurance policy limits, I will help you pursue additional compensation by filing a personal injury lawsuit.

The owner of the borrowed vehicle doesn’t have insurance:

If the owner of the vehicle involved in the accident lacks insurance, and it can complicate matters. Ohio law mandates that all drivers carry minimum auto insurance coverage, so ideally, the owner should be insured. However, if the owner is uninsured, we would see if the driver had insurance coverage. If so, their insurance would compensate the victim(s).

Example: Alex drove his friend’s car and causes an accident. His friend doesn’t have insurance, but Alex does. His liability coverage would then to cover the costs associated with the accident. If neither the car owner’s insurance policy nor Alex’s policy provides adequate coverage, the at-fault driver, in this case, Alex, may become personally responsible for covering the damages.

This is a very frustrating circumstance to be in. The owner of the car and the driver have proven to be irresponsible, by not having insurance, but don’t worry, I’ll Make Them Pay!®

The owner and driver of the borrowed vehicle have insurance:

When the driver of the borrowed vehicle has insurance, it can provide secondary coverage. In this scenario, the owner’s insurance remains the primary source of coverage, but the driver’s insurance is the secondary source of coverage.

If Mark borrows his sister Lisa’s car and causes a car crash, and Lisa has insurance, her policy would be the primary coverage. However, if Lisa’s insurance coverage is insufficient to cover all the damages, Mark’s personal auto insurance policy may come into play to provide additional coverage. This secondary auto insurance coverage can help bridge the gap between the owner’s policy limits and the total costs associated with the accident.

The driver of the borrowed vehicle doesn’t have insurance:

If the driver of the borrowed vehicle lacks insurance, and the owner of the vehicle is also uninsured, it presents a challenging situation. In Ohio, all drivers are required to maintain car insurance policies, and driving without insurance can lead to legal consequences.

If an uninsured driver borrows his friend car and causes an auto accident, but both lack insurance, they have a problem. The injured accident victim would likely file a personal injury lawsuit against the driver and owner of the car.

As one of the most successful Cleveland car accident lawyers, call me today, and I’ll Make Them Pay!®

What Does Insurance Cover?

When you are involved in an accident where the at-fault driver borrowed a car, the coverage depends on the policy limitations, and the circumstance of the accident.

Property damage:

In the event of an accident where the at-fault driver is using a borrowed car, the car owner’s auto insurance company policy typically serves as the primary source of coverage for property damage. This includes the cost of repairing or replacing the damaged vehicles involved in the accident. This coverage ensures you are not left with the financial burden of repairing or replacing your car if it’s totaled in the accident.

As an experienced car accident attorney, I know insurance companies do their best to minimize their accident payouts. That is until they have to deal with me!

Bodily injury liability:

Insurance coverage for motor vehicle accidents also extends to bodily injury liability. If you were injured as a result of the driver’s actions while they were driving the borrowed car, their liability insurance should pay for your medical bills, rehabilitation, and other healthcare expenses. This coverage ensures you receive necessary medical care and treatment.

Property damage to other structures or objects:

Coverage isn’t limited to just the vehicles involved. If the at-fault driver borrowed a car and crashed into a fence, building, or road sign, the insurance policy should cover the repair or replacement costs for the damaged property.

Personal injury protection or medical payments:

Depending on the insurance policy, there may be additional coverage for medical bills. Personal Injury Protection and Medical Payments are types of coverage that can help with medical expenses, regardless of who is at fault in the accident. If the at-fault driver has Personal Injury or Medical Payments coverage on their policy, it may assist in covering your medical treatment costs.

Uninsured/Underinsured motorist coverage:

If the at-fault driver is borrowing a car and doesn’t have adequate insurance to cover your damages, your own uninsured/underinsured motorist coverage may come into play. This coverage is designed to compensate you for your losses when the at-fault driver’s insurance is insufficient or non-existent. It can help bridge the gap between the at-fault driver’s liability coverage and the actual costs you incur due to the motor vehicle accident.

Additional liability coverage:

In some cases, the at-fault driver may have personal liability coverage that extends to them when they are driving a borrowed car. If their coverage limits are higher than the car owner’s policy, it may help cover additional expenses, such as medical bills and property damage.

Insurance policies are complicated, and the insurance companies are in it for the money, which means they are not always doing what is best for their clients. I have been a car accident lawyer for more than 40 years, and have a lot of experience dealing with insurance companies. If you have been in accident with someone who has borrowed a car, you need to call me today. Whether compensation is involves dealing with the insurance company, or we have to file a suit against the driver of the car, I’ll Make Them Pay!®

Dealing With Insurance Companies

Working with me can make a world of difference when dealing with insurance companies during this challenging time. Here’s why it’s crucial to hire me as your borrowed vehicle accident lawyer:

Legal expertise

I have a deep understanding of Ohio’s auto insurance laws and regulations. This expertise allows me to provide you with accurate legal guidance to handle your case most effectively.

Negotiation skills

Dealing with insurance companies can be a daunting task. My negotiation skills are a valuable asset when it comes to advocating for your rights and interests. I can engage with insurance adjusters on your behalf, making sure they consider all your needs and losses, including medical bills, property damage, and pain and suffering.

Claim assessment

I will thoroughly assess your case, gathering evidence, and evaluating the extent of your damages. This includes reviewing medical records, accident reports, and any available witness statements. I work with a team of experts to ensure that no aspect of your claim is overlooked.

I will take care of everything

I understand that dealing with the aftermath of an accident can be physically and emotionally challenging. While you recover, I will be your legal advocate and will handle everything about your case.

Strategic planning

I will guide you through the best course of action. This may involve negotiating with the insurance company or pursuing legal action, I’ll also give you my personal cell phone number, so you can call me whenever you have questions.

Communication skills

Effective communication is key to dealing with insurance companies. my team will handle all interactions with insurers to ensure your rights are protected.

I became a lawyer to help the people of Cleveland and I’ll Make Them Pay!®

Statute of Limitations for Filing a Borrowed Vehicle Lawsuit

If you plan to file a lawsuit against the at-fault driver, you should keep in mind that Ohio has a two-year statute of limitations on most car accident cases.

For most borrowed accident lawsuits, the clock on the statute of limitations begins to tick on the date of the accident. From that date, you will have two years to get your lawsuit filed. You do not need to complete your lawsuit within this timeframe, but you do need to officially file your claim. I can help you every step of the way.

Call My Office Today for More Information

It is important to know that getting into and accident with someone who borrowed a car does not mean there is no option for filing an auto insurance claim.

Whether you were involved in a collision when you were in a borrowed vehicle, or you were injured by an at-fault driver in a borrowed vehicle, I can help you seek the financial compensation you deserve. Call me today at 800-556-4769 to learn more about the services I provide to injury victims as an experienced Cleveland car accident lawyer. I’ll Make Them Pay!®

ASK TIM A QUESTION

NO COST TO YOU!

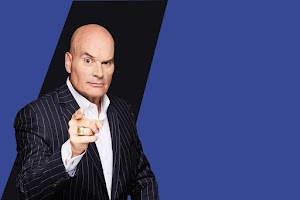

There's the Tim Misny you see on the billboards and on TV, but there's another Tim Misny that I know up close and personal.

The Tim Misny I know is genuinely passionate about helping the hard working little folks who get pushed around the big folks. He actually, really honestly cares about people who run into bad luck at no fault of their own. Tim has quietly, out of the sight of cameras and with no fanfare shared generously with the marginalized in our society; single moms, Veterans and others without expecting anything in return.

He calls them like he sees them and you wouldn't want to take your troubles to anyone else.

Thank you Tim for being a light in this community!

City, State and Above State Level Situation .

Pro Se !

Thank you Tim

father figure one day. Tim loves nature & shares the true beauty of nature with how he raises his kids. From biking through trails & having his kids learn how to nurture the family garden - he teaches valuable lessons on how to appreciate the world we live in. I know that Tim is just a phone call away & always urgent to responding no matter the situation. He has given me some of the greatest advice & continously throwing positive energy my way! I'm honored to know him & be a friend of his. He is the true practioneer of changing lives & paying it forward. He has taught me so much in just a short amount of time. Tim Misny, a man that wakes up every single day to make a difference!

After I helped him through the checkout and he left, many different employees at the garden center asked me if I knew who that man was. I did not. They told me, “That’s Tim Misny!” Once I figured out “who” Tim Misny was, my confidence grew. It was a pivotal moment. One in which steered the rest of my life. His words stuck with me. I worked hard and obtained my Associate’s Degree in Criminal Justice. I was hired by a local Law Enforcement Agency at the age of 21. I was sent to the Ohio State Highway Patrol Academy, which was an extremely tough place to be, to say the least. At the Academy, they try to break those who don’t have a determined spirit. On days I wanted to quit, I remembered Tim’s words. Maybe it was fate, maybe it was random chance.... I’ll never know But, Tim Misny helped me have the confidence and determination that was necessary to be where I’m at today. I’ve been a law enforcement officer for over 16 years. I’ve told this story to many of my coworkers.

Tim, you’ll never understand how your words that spring day helped shape my future. Your words enabled me to provide a great life for myself and my family. I’m forever grateful.

Mike

The personal attention and clarity of the matter and specifics, gave me a state of comfort and satisfaction that I could have found nowhere else! I will be forever grateful to have Tim Misny as my attorney and my friend!

I am a businessman in the Greater Cleveland area and have directed various members of my staffs as well as personal friends to Tim for solutions to their personal injury case needs. All my referrals have been more than pleased with the service and personal treatment they have received from Tim and his staff.

I strongly recommend Tim Misny and his associates should you ever need the finest legal services available in Ohio! Trust is his number one priority, trust in knowing that you will be his client second, his friend first!